An adviser who has been in the industry for 20 years plans to dispose of part of their clientele. The business carve out is of risk.

Income is made up of:

Insurance renewal commissions of circa $200K p.a.

Describe the methods of fee payments by clients. Annual & monthly.

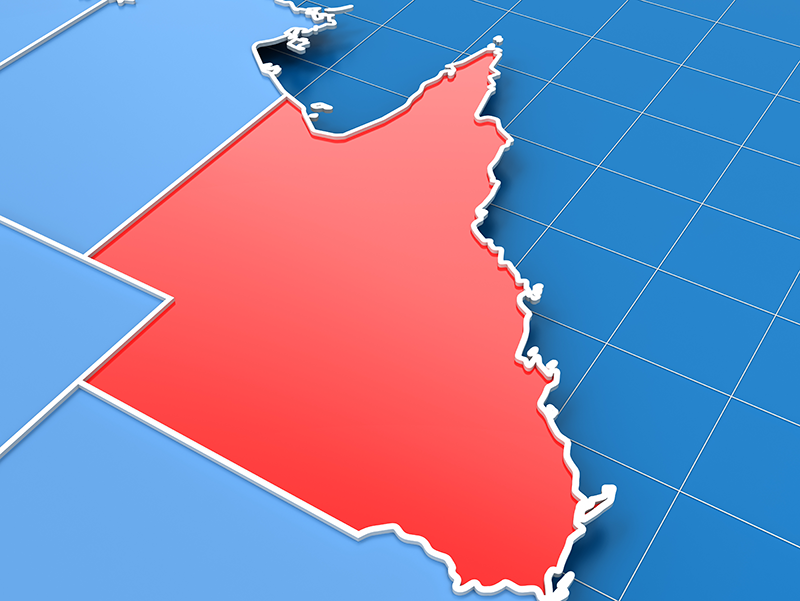

There are approximately 250 clients in the business. 75% of the clients are based in Queensland.

The make-up of the client base is PAYG, Professionals, Retirees, Accumulators, Mums & Dads and Tradies.

The clients’ age brackets are:

| Under 40 | 20% |

| 40-55 | 51% |

| 55-60 | 8% |

| Over 60 | 21% |

The main insurance product providers are:

| AMP | TAL | AIA | Onepath |

| Zurich | BT | Comminsure | Colonial |

| MLC | Asteron | Metlife |

The records storage system is with XPlan & Sharepoint

Potential. The following are the opportunities for reviews:

| Cross generational referrals | ||

| Shares | Property | Mortgage Broking |

| Finance Broking | General Insurance | Finance/Leasing |

The vendor is looking for 3.00 times RR with 90% up front and the balance within 12 months.

Preference will be given to acquirers with approved funding in place rather than a contract that is “subject to finance”. No vendor finances available.

All negotiations are subject to a signed NDA with the vendor prior to the release of any data.

This is an ideal opportunity for someone looking to acquire a clientele generating substantial amounts of income from a loyal client base with excellent referral systems.

The vendors are willing to talk attractive terms for the purchase with an upfront investment, reasonable handover protocols and standard run off provisions for the right cultural fit.

For more information and a prompt introduction please call Jim Prigg on 0408 520 453 or jim@knowledgemaster.com.au.